- You are here:

- Home »

- In The News

Category Archives for In The News

Currency Valuation Methods Leaked?

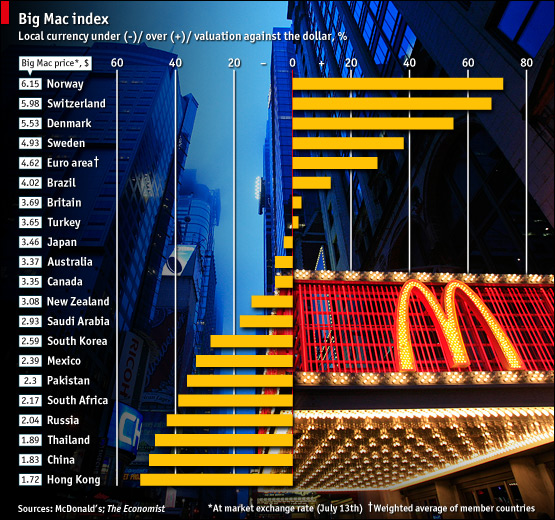

Ever hear of the Big Mac index? We’ve successfully used it as a guide to valuing currencies and as such, it provides some really interesting insight into the world of valuation. The index (thanks to The Economist) is based on the idea of purchasing power parity (PPP), which states that currencies should trade at the rate that makes the price of goods the same in each country.

So if the price of a Big Mac translated into dollars is above its average cost in America (currently $3.57), the currency is more costly; if it is below that benchmark, its a bargain. This month, a Big Mac in China is half the cost of one in America. Other Asian currencies appear to be similarly undervalued. At the other end of the scale, many European currencies look over-valued. That is, excluding the ever so humble British pound, which was more than 25% overvalued a year ago, is now approaching ‘fair’ value parity with the USD.

Here in Switzerland, it is a different story. The Big Mac with it’s 100% Swiss beef and side order of fries made with 100% Swiss potatoes turns into a comparably priced meal when compared with local restaurant fare. Many Swiss see the brand as a status symbol rather than a fast, fattening food source and thus.. they don’t seem to mind over-paying for the value received which results in skewing our lovely currency valuation index.

Non the less, what we have learned is that non EU countries such as Switzerland & Norway command higher prices and have higher currency valuations than those in the European Union followed by the USD and then trailed by Japan, Australia, the Middle East, Russia and Asia. What’s this all mean? Pack your bags, it’s time to go shopping in Asia!

Product Promotion?

I just read a police report online from the lovely state of Georgia, USA and it was pretty strange… the theft involved more than 6,000 post it notes! So, I G00gled it and and discovered that Students @ the Savannah College of Art and Design recently produced a Post-it ‘Stop Motion’ Art Film.

Initially I thought: “Is there a cooler way to market your product than to show the world a few outlandish ideas produced by your Customers?”

Then I remembered the police report and wondered where these students got so many new post it notes… hmmmm

httpv://www.youtube.com/watch?v=BpWM0FNPZSs

and of course… there was the ‘making of’ video:

httpv://www.youtube.com/watch?v=ArJYvaCCB3c&feature=player_embedded

Brilliant Linguistics

I am going to dedicate this article to phrases, quotes and sayings that I come across during business discussions, coaching sessions and educational experiences as a living reference for things people say and write that are so incredibly effective… I could not improve on them if I wanted to.

The first one was uttered by an incredibly good salesperson who refused to pitch anything until he knew what the person he was communicating with wanted. This salesman used a brilliant, easy-going method to uncover his Customer’s desires, objectives, wants, needs etc. and then orient the pitch around helping the person (his Customer) achieve his goals. Among others, his trademark follow up was:

“What would you definitely buy from me today if only I were smart enough to offer it to you?â€

If you are ever on the receiving end of this question, have your wallet ready because the psychology of the query is more powerful than most people realize. This is a killer line and there really is no escape from it once it has been thrown into the court.

Going in a completely different direction, here is a quote that is simply remarkable.

“In times of change, learners inherit the earth while the learned find themselves beautifully equipped to deal with a world that no longer exists“

Each week we meet with senior executives with professor doctor titles running multinational corporations. Most are convinced that they did everything by the book and can not understand what is going wrong – why is their business not performing as expected? Their concerns almost always deal with situations that were not described in reference books or textbooks in years past. While education is important, a continuous cycle of learning is even more important. Today’s business managers need to equip themselves for an age where the only certain thing is uncertainty in a climate of constant change. You need to be a learning machine accepting that what you learned yesterday might not help you tomorrow. The quote above was written in the 1950s!

Investing… When is it ‘the right time’?

I decided that NOW is the best time to invest…

and you can quote me on that one.

Hey, it beats the heck out of Clients calling to cancel projects because they decided to act like

blinded deer at night standing in front of a speeding truck full of ‘industrial disease’.

I don’t care what anyone says… now us the time to invest… if not in the markets, then in ourselves.

Get out there and learn something new.

shameless plug: we give exciting courses on how you can dramatically increase your sales even in slow markets – hack, we even back it up with proof from our Clients and a money back guarantee… are you brave enough to challenge yourself?

Is Identity Theft a Real Threat?

Friends, this article is serious. Based on a study conducted by Paypal in 2008, Internet users in the UK are much more likely to be victims of identity theft than their peers in both Europe and the USA.

The recent survey by PayPal and Ipsos Research of 6,000 online shoppers in 6 countries revealed that 14% of respondents in the UK admitted that they have had their identities stolen online. This can be compared with only 3% in Germany. More than half of respondents said that they used personal dates and names as passwords, making it relatively easy for hackers to gain access to accounts through manual efforts of trial and error. The French are particularly bold – two-thirds of the respondents claimed to use easily guessed passwords such as birthdays and telephone numbers but the icing on the cake was that over 80% of the French post this sort of personal data on social-networking sites. Unfortunately, the hackers enjoy trolling the very same social media sites too.

The article did not reveal how users could protect themselves so, in an effort to provide some form of public service… here are my recommendations:

1) Do NOT reveal detailed personal information on a public internet site such as myspace, facebook etc

2) If you have already ignored recommendation number one, check all of your passwords and ensure that they are at least 10 digits long and that they contain a combination of uppercase and lowercase letters, numbers and symbols such as # $ % ( ^ ) etc.

3) a strong password is something like RtY7f*e#2U and a weak password is something like 041277. To check the strength of your passwords, try using the Password Meter – you can even download it to increase your security based on what I am about to reveal to you in the next recommendation.

4) You may have already inadvertently downloaded some sort of spyware that is recording what you type and then transmitting the result to a hacker, a hacking community or an online thief. If you are running Microsoft windows without anti-virus or firewall protection, you might as well raise the white flag and surrender today. Even with both anti-virus software and a leading firewall installed, if you were teased into clicking on some sort of advertisement that downloads a file or more to your computer, chances are reasonable to good that your machine has been infected. One last comment on this topic before we move on – many people have a free version of an anti-virus software installed and they somehow manage to forget to update it regularly thus leaving their machine susceptible to attack. Solution… get a Macintosh and don’t click on links that promise ‘free porn’ or music downloads. For the paranoid among us, add anti-virus software to your Mac and then get back to work

5) Change your password regularly. Do not keep the same password for more than 60 days

6) Create a secure place to store all your passwords and keep them protected with encryption. Put them somewhere safe but easily accessible. My suggestion is to create a secure email account and use their document repository service to give you access from any location. Here is a leading secure email service that offers a free secure email address.

7) Review ALL of your passwords for online banking, email, secure web sites etc and change the password to something stronger today.

enough said, now let’s get back to our regularly scheduled broadcast ;-)

A Financial Maverick @ Work

Once upon a time in a jungle village not so far away, a man appeared and announced to the villagers that he would buy live and healthy monkeys for $10 each.

Since the villagers considered the monkeys a real nuisance, many of them went into the jungle and began setting traps to catch them. The man bought thousands of monkeys at $10 and, as supply started to diminish, the villagers reduced their efforts. When this happened, the man announced that he would now buy monkeys at $20 each.

This reinvigorated the villagers efforts and they started trapping monkeys again. Gradually the number of free monkeys diminished even further making hunting efforts much more challenging and time consuming – people started going back to their farms. The offer was increased to $25 each, until it was difficult to find even a single monkey, let alone catch it!

The man then announced that he would buy monkeys at $50 each! However, since he had to go to the city on some business, his assistant would now buy on his behalf. As soon as the man was off on his journey, the assistant let the villagers in on a secret. He invited all the hunters and their relatives to have a look at the monkeys in the big cage that the man had paid for. And then he made them an offer that they simply could not refuse.

“I will sell them to you for $35 and when the man returns from the city, you can sell them to him for $50 each as he promised.”

The word spread like wild fire and before long, most of the villagers gathered their savings and managed to buy every single monkey held captive in the massive cage before releasing them into the jungle so that the hunt could begin anew.

They never saw the man nor his assistant again.

In the above article the names were changed to protect the innocent. The ‘financially sound’ structured products were represented by monkeys in the story but the facts remain the same; this was no accidental occurrence it was simply a version of the now popular Ponzi game. You probably already know this but, a ponzi scheme is a scam where the perpetrator collects money from new investors and uses these new cash inflows to pay high returns to past investors, so that these influencial existing investors believe that their capital is intact and working for them. All the while, the scam artist has been spending the initial capital on himself rather than investing it as advertised. To attract a special breed of greedy investor, such schemes often are promoted as exclusive clubs as in ‘by invitation only’ thus toying with the wealthy and famous have-it-alls psyche to the point where they absolutely must be part of this exclusive ‘winners circle’ in order to maintain their image.

Should Everything Be Free?

As we sell more and more iPhone Apps, we collect more and more feedback from both our Customers and people who think that everything on the iPhone should be free. At first we were dismayed by the prospect that an entire generation of people (many iPhone users) actually paid for the mobile phone but now expect software developers to design, code, test and launch applications for free given the efforts involved, the costs for the hardware and the coding tools etc. We initially wondered how we could possibly make it happen. Could software be offered for free?

On a bustling corner of Sao Paulo’s quita district, street vendors pitch the latest “tecnobrega” CDs, including a few by a hot band called Banda Calypso. Like CDs from most street vendors, these did not come from a record label. But neither are they illicit. They came directly from the band. Calypso distributes masters of its CDs and CD liner art to street vendor networks in towns where they plan to tour, with full agreement that the vendors will copy the CDs, sell them, and keep all the money. That’s OK, because selling discs isn’t Calypso’s main source of income. The band is really in the performance business – and business is good. Traveling from town to town this way, preceded by a wave of supercheap CDs, Calypso has filled its shows and paid for a private jet. Not a bad way to offer free software we thought.

Back at ground zero, our developers were asking for their paychecks and our freelancers were requiring payment for Apps that had just been accepted for launch. We can’t blame them for wanting money after all, they need to eat too but, this same generation of gotta-haves want to get paid for their time and yet expect most things that they need to be free – someone is going to have to pay for all this free stuff if you read your college ECON 101 textbook it’s likely to define economics as “the social science of choice under scarcity.” The entire field is built on studying trade-offs and how they’re made. Milton Friedman himself reminded us time and time again that “there’s no such thing as a free lunch. But Friedman was wrong in two ways. First, a free lunch doesn’t necessarily mean the food is being given away or that you’ll pay for it later, it could just mean that someone else is picking up the tab. Money is not the only scarcity in the world today… the other items include time and reputation. if you build on reputation, you gain respect especially in the troughs of a given niche market. If you increase attention you can actually build a business as you convert from reputation to traffic and traffic as many of us in this digital age know, can be converted into cash. There is, presumably, a limited supply of reputation and attention in the world at any point in time. These are the new scarcities – and the world of free exists mostly to acquire these valuable assets for the sake of a business model to be identified later. This ‘free mentality’ shifts the economy from a focus on only that which can be quantified in Euros, Dollars and cents to a more realistic accounting of all the things we truly value today.

How a company presents an offer for a product today differs in many ways from the past in that the price of each individual component is often determined by using psychology, not cost. Your mobile phone company may not make money on your monthly minutes – it keeps that fee low because it knows that will be the first thing you will compare when picking a carrier – thus another component, your data volume and your monthly voice mail fee is pure profit to the carrier. So you see ads for free phones but I have yet to encounter free calling plans.

You get the pipes for free but the water passing through those pipes is expensive. So, what are we to do about our dilemma? Many of our target prospects want something for free and yet our developers need to eat. If we were to offer a free ‘lite’ version, then we would encounter higher dev costs and support costs but the idea has crossed our mind.

Wait, there is another way… How about building real value into your offering so that people won’t mind spending some spare change if an App helps them do something that they wanted to do before but were not able. If an App were to focus on leveraging those scarce resources that we listed a few paragraphs above such as helping a user to save time, gain respect or save money – the App would pay for itself and that, in essence, is currently our favorite model of ‘free’.

Coaching Services

I have some amazingly good news to share with you (and a small group of others – we’re not advertising this yet so please keep this to yourself for now), but first here’s a little background.

Ever since BoxOnline was launched in 1999 people have been asking us for personal one to one coaching.

I’ve had to say no hundreds of times for several reasons.

First, I did not have a trained staff of coaches.

Sure, I could have hired a professional “coaching company” to take on the task, but frankly most of these programs are pretty sub-par to say the least and I did not want to forward the calls to India.

Heck, their idea of coaching is to get someone on the phone and push play on a tape deck!

That’s not coaching – that’s highway robbery no matter how you slice it.

So, the years passed and we have been unable to service this need.

Some thought I was foolish for “leaving money on the table” and maybe they’re right, but some things are more important than money.

Giving people a high value for their dollar, taking a genuine interest in their success, honest dealing …

Not only are those wise principle to live by – they make great business sense, too.

What a lot of these companies offering coaching don’t get is that they can cut costs by offering shoddy service, but they are losing someone who is a potential lifetime Customer.

I finally found a coaching company that shares this same philosophy.

Not only is what they are teaching completely in line with the core principles we built our business upon (their coaches help you take them to the next level), but they have strict quality control

measures to ensure their coaches are actual *coaches* and not salesmen in disguise or “clock punchers.”

They have an extensive screening process for their staff and if a coach survives that, they are under constant review and provided with excellence training to keep getting better and better at

what they do (coaching you to unleash your hidden potential).

We’re only offering this as a pilot program to a few people now – not everyone will be accepted.

If you’re interested, please fill out our application form and one of our staff members will get back to you right away.

Investment Evaluation Guidelines

I have been asked many times for a guideline when it comes to evaluating investments that we (or our Clients) make. People ask why we invested in Company X and not in Company Y, Why are we interested in industry A more than industry B etc.

Well, the simple truth is that we invest to win.

We tend to strip out a lot of soft factors and focus on results.

Did management deliver?

Can they do it again?

A lot of investment decision making is based on an understanding of industry trends, a trusted relationship with players that perform consistently above industry average and some form of defensible proprietary technology that is in demand because it solves a specific pain for a given market segment.

If a company has a specific target market segment in their crosshairs, we know that they have done their homework – when management states that they serve all industries, our alarm bells start ringing.

Following is my personal guideline for what really counts when considering investment in a startup or early stage company.

1) Market potential

2) The Team

3) Results

4) USP

Investment Process

- The success of investment in an early stage company depends on people and their ability to execute on a detailed business plan, therefore a lot of emphasis is placed on the team.

- The structure of the investment is vital and requires creative and often complex terms.

- Pricing is a key factor which needs to be carefully analyzed and negotiated.

- An interesting exit strategy is required in order to maximize a timely return.

Investment Selection

- Management Team: Experienced, in-depth knowledge of business, results oriented.

- Innovative Products/ Proprietory Technology: Highly differentiable, superior, specialized expertise, meets market needs.

- Business Plan/ Milestones: Well thought out business plan including milestones and contingency plans.

- Substantial Investment Position: Ability to obtain a substantial investment position, influence the selection of executive management and the strategic direction of the company.

- Valuation: Negotiate and obtain a fair pricing structure.

Initial Investment Valuation

- Underlying industry assumptions

- Realistic income statement over 3-5 years

- Competition

- Major criteria:

- Technology value

- Capital requirements

- Market potential

- Capital structure

- Operational cash flow

Determination of NAV for privately held startup companies

- The original cost: An approximation of the fair market value at the time of the transaction.

- Write off: NAV calculation at cost, less any write-off deeemed necessary if subsequent performance fails to meet business plan forecast.

- Capital increase: NAV calculation in principle based on the capital increase price, less 10% to 29% discount if deemed necessary based on valuation factors.

- Write up: A write up is recognized when a significant event occurs such as increased profitability and achievement of milestones.

The Next Big Thing

I spent a good amount of time reviewing business opportunities in China both locally and from abroad in 2006/7. The overwhelming conclusion I drew was that there is enormous potential in almost every sector of the economy driven by both foreign demand and local consumption capacity. Some companies were not able to produce enough product to satisfy local and regional demand let alone national demand in China yet, as I stepped into the reality that is the China of today, I discovered that I needed to shed my preconceived ideas that China’s production capacity exists to serve foreign interests. Sure, international markets are of great importance to the Chinese manufacturing sector but, the number of companies I reviewed that produced product for export only were few and far between.

China is a gigantic market just getting ready to shift into a consumer oriented phase. So, what exactly was I doing in China? Well, I figured that if I could identify sectors with the strongest production growth this would give me some insight into a future global trend that helps to answer my number one question… what is going to be the next big thing? and… how can I come up with a best guess estimate before the world wakes up and smells the coffee?

So here is what I did. I reviewed the following industries and their largest manufacturing partners in China.

Lighting: including LEDs and Displays

Optics: lenses of all shapes and sizes including x-ray… yes, x-ray lenses!

Sensors: the kind that are able to sense 5 particles per million for security applications fighting potential terrorist threats

Actuators: MEMS, NEMS MOEMS and NOEMS… don’t even ask plus medical testing devices

Storage: mechanical HDDs are on their way out or are they? I had a 100 GB solid state drive in my hand

Semiconductors: What is the biggest obstacle to progress on Moore’s law these days… I found out!

Energy: Well, with the rising price of fossil fuels alternative is the only way and improving methods of harvesting energy were on the list of the coolest inventions I saw

Biotech or as it’s known today… life science – DNA manipulation seems to be all the rage but what caught my attention was the ability of some companies to grow skin and…

Ok, enough! if I haven’t bored you by now you are probably wondering what this article is all about.

Well, I thought that if I were able to analyze what is being produced today and get an idea of what is coming down the pipe to satisfy the needs of tomorrow then I could gain some valuable insight into who will manufacture the next big hit for tomorrow… for several different industries and kind of hedge my bet. I got lucky, I discovered something even more valuable.

In my research I analyzed all major players in the above industry sectors and put together something like a roadmap for each. Although the time lines vary as each company plans to move its invention from the R&D phase into production and no one is able to forecast consumer or business demand for 5 years from today, there were some very interesting correlations. One was size. Products will be getting smaller – fact. Another was that products will be influenced more by market need (pull) rather than an inventor’s desire to create a new market (push). Lastly, ROI is playing a greater role in how long a particular invention is allowed to cook in the R&D labs before it is forced out the door to an awaiting and already expectant consumer market.

How about a summary of my thoughts? OK, take the current products manufactured today, do research on where they are headed, look into the components that enhance or add value to each of these products and see if there are a few companies that produce the next generation of these components – then limit the study to less than 10 industries where these components are bound to have major impact.

Do you see where I am headed with this now? If I can identify companies that produce something really small on a micro or even nano scale that improves today’s products and will be integral in moving tomorrow’s products forward, I will have successfully identified a winner in not one but several industries.

In my most recent estimation, there are not a lot of these players out there but they do exist and I am hunting them down one by one. Did I mention that I am already in discussions with one?

Yes, I believe that I have identified the first of several of these core component providers. If you have read my article this far, then you may want to contact me to learn more because information this hot, can not yet be published in an open forum. Alas, the search continues and a new project is born to narrow down the hunt for the next big thing.