- You are here:

- Home »

- In The News

- » Currency Valuation Methods Leaked?

Currency Valuation Methods Leaked?

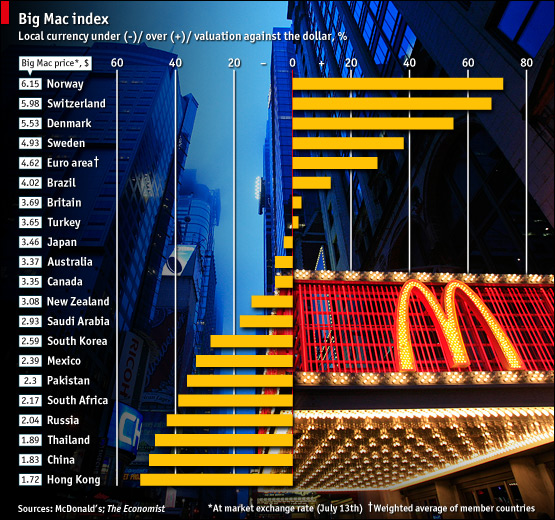

Ever hear of the Big Mac index? We’ve successfully used it as a guide to valuing currencies and as such, it provides some really interesting insight into the world of valuation. The index (thanks to The Economist) is based on the idea of purchasing power parity (PPP), which states that currencies should trade at the rate that makes the price of goods the same in each country.

So if the price of a Big Mac translated into dollars is above its average cost in America (currently $3.57), the currency is more costly; if it is below that benchmark, its a bargain. This month, a Big Mac in China is half the cost of one in America. Other Asian currencies appear to be similarly undervalued. At the other end of the scale, many European currencies look over-valued. That is, excluding the ever so humble British pound, which was more than 25% overvalued a year ago, is now approaching ‘fair’ value parity with the USD.

Here in Switzerland, it is a different story. The Big Mac with it’s 100% Swiss beef and side order of fries made with 100% Swiss potatoes turns into a comparably priced meal when compared with local restaurant fare. Many Swiss see the brand as a status symbol rather than a fast, fattening food source and thus.. they don’t seem to mind over-paying for the value received which results in skewing our lovely currency valuation index.

Non the less, what we have learned is that non EU countries such as Switzerland & Norway command higher prices and have higher currency valuations than those in the European Union followed by the USD and then trailed by Japan, Australia, the Middle East, Russia and Asia. What’s this all mean? Pack your bags, it’s time to go shopping in Asia!