- You are here:

- Home »

- Opportunities

Category Archives for Educational

Personalities

There are four basic personality types. In order for a company to succeed in today’s global business environment, each of these personality types needs to be integrated into as many teams as possible to provide balance and, in many cases an important competitive edge. The key is having the right tools and mindset in order to accurately identify each trait and then know how to position the various types in the organization so they have the best chance of achieving success and interacting well with their managers and co-workers.

THE LEADER – THE “A” TYPE PERSONALITY

“A” type personalities are the ones that are always “looking for a better way” or building a “better mouse trap”. They have an entrepreneurial streak and don’t mind taking risk in order to receive the rewards that can go along with it.

The “A” personality is usually very independent, direct and to the point. They will probably tell you to “get to the bottom line” or give them the “executive summary” to read. They don’t like routine and often delegate routine chores to someone else.

The “A” Personality enjoys change, and one of their biggest fears is falling into a routine. They are very focused on what they are doing and are almost always relatively insensitive to others that might be around them. If they tell somebody something, or explain it, they’ll say it ONCE and expect that everybody listening understood because they’re ready to move on.

“A” type personalities are often found as business owners, managers, sales people (especially straight commission), or any position requiring a very “direct” person that typically “takes charge” and forges ahead. They are very decisive and persistent in getting what they want and need.

THE SOCIALIZER – “B” TYPE PERSONALITY

The “B” type loves to party, travel and be part of groups, and is often the center of attention. They love excitement and are often impatient and demanding as a result of being a “high energy” type. They love the limelight and the “hype” and often do very well in sales, advertising, marketing, public speaking, party planning, travel and other positions where they can have a “good time” while working.

The “B” personality is as Supportive of others as they are direct in their approach. Most people enjoy being around them or watching or listening to them “perform”. Many radio and TV personalities, actors and high-profile speakers are often “B” personalities. It is very important for the “B” personality to be liked by others and can be easily hurt if they think someone doesn’t care for them. They may take it very personally.

A “B” type believes that the world revolves around them… they can be a bit narcissistic and often think things like: “It’s all about me” “Aren’t I great?” This type often does well in sales as they tend to be very talkative and outgoing with people and are normally quite persuasive.

THE INFORMATION HOUND – “C” TYPE PERSONALITY

If you want to picture a typical “C” type personality, think of your accountant, an engineer or a computer programmer or analyst. The “C” thrives on details, accuracy and takes just about everything seriously. They are usually very neat, dress fashionably and are very calculated and precise in just about everything they do.

The “C” doesn’t like “hype”, rather, they want facts… information from which they can verify the details and make a decision. They are very consistent in everything they do because everything has an order or procedure; thus they can be predictable at times and often very dependable, however, don’t expect them to make a decision when YOU want it, as it will only come after THEY have checked all the facts and are satisfied that everything is correct.

They are deep, thoughtful and usually very sensitive. They enjoy know how and why things are the way they are rather than taking anything at face value. They often make good customer service people and sales people, especially if the product to support or sell is something “technical” or involves numbers. They are loyal and patient and can leave customers with a good feeling that they’re somebody that really cares. However, managers may need to make sure they don’t spend TOO much time with details if the objective or expected outcome doesn’t warrant the investment of their time and expertise.

ALWAYS THERE WHEN YOU NEED THEM

THE “D” TYPE PERSONALITY

The typical “D” personality doesn’t like change, preferring instead, to have a set of guidelines from which to follow and they won’t mind doing the same thing over and over. They are usually more motivated by security and benefits and are likely to get the “gold watch” if the company can provide the security they seek.

“D” types are very supportive of others and are often the type that others turn to when they have a problem. Their compassion level is usually quite high and often seem very happy and content with themselves and life in general. They are usually punctual, and consistent. They add “balance” and support in the workplace and may be the champion of the “under dog”.

OPPOSITES

The highest potential for personality clashes is when opposites are working with each other or one working for another in a business environment.

“A” and “D” personalities are opposite of each other. The “A” likes change, is impatient and a risk-taker. The “D” dislikes changes, is very patient and thinks the “A” is crazy for taking so many risks preferring instead to be very steady and seek the security of knowing what you have and what you can count on.

The “B” and “C” personalities are opposites as well. The “B” loves the glamour and the hype, the “C” insists on knowing if there is any “substance” behind it all. Where the “B” can be messy, the “C” is neat and orderly and doesn’t thing “by the book”. The “B” is Extroverted, the “C” is Introverted.

Opposite personalities can also compliment one another if each tries to understand the other’s perspective. Perhaps this is why opposites often marry and lead a very full life, since each makes up for the other’s weaknesses and each brings important characteristics into the relationship.

However, opposites can be a bad thing too, especially if undetected, and not properly managed in the work environment. We have seen many examples where a client will call us complaining of turnover in the sales department, for example. They need a better way to “assess” sales people because the ones they hire never seem to last long enough.

After assessing their sales staff, we’re sometimes surprised to find that their personalities should be very good for the job they are doing, but when we look into their manager or supervisor, we find that they are being managed by an Opposite Personality who expects them to do things in a way that is incompatible with the sales people’s personality!

An example you’ll see us use often is Oscar Madison and Felix Unger from the TV show, “The Odd Couple”. It isn’t hard to imagine the friendly, outgoing “B” type Oscar being a top sales person. He makes friends and builds relationships wherever he goes and seems to do the work of 2 or 3 other people.

If the neat, precise “C” type Felix is his manager and is always demanding that every blank on every sales report is filled out, neatly and on-time every time, it isn’t surprising to see that this won’t work out for long. Nothing is “wrong” with either person, they just need to have more insight into each other’s personalities and find reasonable middle ground from which to work. However, if the manager is inflexible and demands perfection in everything they do, it isn’t surprising to see a lot of turnover in the people that would work for him, especially if the ideal candidate for the sales job was a “B” personality.

Almost everyone has been in this position at one time or another. Even though two people may have opposite personalities, we also have a factor called “adaptability” in human nature, and when presented with a better understanding of what is needed, especially in understanding other people, many can adapt and the results are often almost immediately positive. I wonder how many issues could be resolved with just a few minutes of thinking and a few seconds of adaptation.

Are you an Entrepreneur?

There is a lot of discussion these days about what defines a true entrepreneur and whether financial success is a pre-requisite of being an entrepreneur. Well, rather than argue moot points, let’s look at this from a practical, self evaluation perspective and see what is revealed. Below I compare and contrast being a freelancer with being an entrepreneur – I can’t wait to read your comments:

- A freelancer is about the work. An entrepreneur is about the business…

- A freelancer is a doer. A freelancer knows the tactics. An entrepreneur is a negotiator, a visionary and a thinker. An entrepreneur builds strategy and is constantly testing it.

- A freelancer thinks the work is the business. An enterpreneur knows the business supports the work.

- A freelancer is disinterested in ‘business controls and necessities’Â – including thinking, budgets, invoices, business plans etc. which all get in the way of the ‘real’ work. An entrepreneur understands that without those ‘business controls and necessities’, it is simply not a business – it’s a job.

- A freelancer might want to grow a Client base. An entrepreneur knows a business either grows or decays, and is constantly looking for ways to keep the growth managed and within reasonable risk parameters.

- A freelancer lives in the now with an eye to long term Client relationships that might afford some security. An entreprenuer is looking to a vision of the business, now is a reflection of what the business will be.

- A freelancer often doesn’t invest in his or her own equipment, training, or help. Many freelancers don’t delegate low-level skills or tasks that they don’t do well, because they think in terms of cost rather than investment and best use of time and resources. An entrepreneur knows that time is money, invests in future development and the business vision. An entrepreneur will pay for skills that he or she doesn’t have knowing that it is money well spent on quality and commitment.

- A freelancer works from day to day. An entrepreneur has a business plan.

VCs.. arrGH!

Many venture capitalists expect entrepreneurs to go out on a limb for them – climbing high while vigilantly sawing away at a supporting branch.

When Clients ask what exactly is needed for funding, I can provide some very interesting answers based on my 20+ years of experience… Here are some of my personal favorites:

An impeccable board of directors

It may not be the first issue you are faced with but this is one of the really important ones. Your board of directors needs to be comprised of a broad spectrum of very skilled individuals experienced in the industry of your company. The venture capitalist firms all look for a strong board and that means a board that brings in money (read Sales), investors and strategic relationships – all the important things you need as an early stage company.

A winning team

You may have a great idea, but if you don’t have a strong core team, investors aren’t going to be willing to bet on your company. Think of this as an analogy to a horse race. Betting on horse races equates to betting on high-tech. Betting on a race is equivalent to betting on the industry your company is in. Betting on a horse is like betting on your company to succeed and betting on a jockey is what a VC is after. VCs want to bet on winners that have proven their abilities before. The team surrounding the jockey is also key but don’t get too caught up in having everyone on board before chasing funds. You don’t need to have a complete, world-class, all-gaps-filled team. But the founders have to have the credibility to launch the company and attract the world-class talent needed to fill in the gaps. The lone entrepreneur, even with all the passion in the world, is never enough. If you haven’t been able to convince at least one other person to drink the lemonade, investors certainly won’t. One other thing… If the founders do not have skin in the game, don’t expect others to invest their savings. To be convincing, founders need to go out on a limb, risk their personal savings, sell their car or get a second mortgage on their home to indicate that they too have risked all to make this company a success.

A compelling idea

“Every entrepreneur believes his or her idea is compelling. The reality is that very few business plans present ideas that are unique. It is very common for investors to see multiple versions of the same idea over the course of a few months, and

then again after a few years. What makes an idea compelling to an investor is that it reflects a deep understanding of a big problem or opportunity, and offers an elegant solution.”

The market opportunity

You should be targeting a sector that is not already crowded, where there is a significant problem that needs to be solved, or an opportunity that has not been exploited, and where your solution will create substantial value. Contrary to popular belief, it’s not about how big the market is; it’s about how much value you can create.

The technology

VCs ask – What makes your technology so great?

The correct answer is, ‘There are plenty of Customers with plenty of money that want to buy it’.

If you have a technological advantage today, how are you going to sustain that advantage in the future? Patents alone won’t do it. You better have the talent or the partners to assure investors that you will stay ahead of the curve.

Competitive Advantage

Every interesting business has real competition. Competition is not just about direct competitors. It includes alternatives, ‘good enough’ solutions, and the status quo. You need to convince investors that you have advantages that address all these issues, and that you can sustain these advantages over several years.

Financial projections

Your projections demonstrate that you understand the economics of your business. They should tell your story in numbers – what drives your growth, what drives your profit, and how your company will evolve over the next 5 years.

Validation

Is there any evidence that your solution will be purchased by your target Customers? Do you have an advisory board of credible industry experts? Do you have a co-development partner within the industry? Do you have Customers or Beta users to whom investors can speak? Do you already have paying customers? The more credibility and Customer traction you have, the more likely investors are going to be interested.

What I have learned is that a company needs good scores in ALL of the above areas and excellent scores in at least 3 in order to have a reasonable chance to secure funding.

Corporate Energy

Yes, this topic is a bit on the esoteric side I admit… but hear me out, there is logic and reason behind the glass. Some colleagues of mine use the following model to judge a company’s investment worthiness. I found it fascinating and have now evaluated a few hundred firms using this technique. Situations at a few companies that I previously worked with made me feel uneasy about the company and its culture but I did not know why. Today, I have a good idea what triggered my feelings and I have come to the conclusion that unless I can change things for the better, I would rather not work with such firms again. These firms were suppliers of mine as well as a few Customers. Read on and assess the technique for yourselves – I’d love to hear your thoughts.

Energy zones

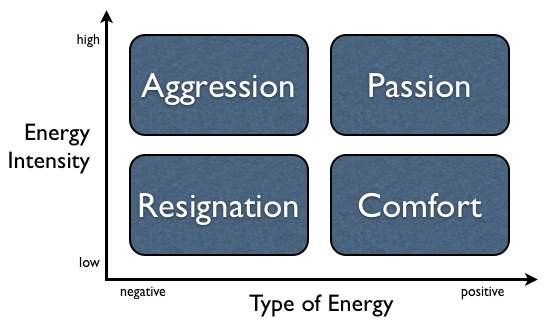

An organization’s energy can be perceived as either positive (driven by enthusiasm, pride, joy or satisfaction) or negative (guided by fear, uncertainty, frustration, doubt or sorrow). Most organizations fall into one of four categories:

1) Comfort 2) Resignation 3) Aggression and 4) Passion.

Companies in the comfort zone have a high level of satisfaction but a low level of action. Thus, its employees might be very content on the one hand but they lack the vitality, alertness, motivation and emotional tension necessary for initiating bold new strategic thrusts or significant change.

Organizations in the resignation area, on the other hand, show both low and negative energy. Therefore, they are not particularly active and their employees may not identify with the company goals at all.

Businesses in the aggression area are driven by a strong, negative energy, which often expresses in an

intense internal competitive spirit and portrays in high levels of activity and alertness. Hence, unlike organizations in the resignation area, they often direct all power towards achieving company goals. The analogy here is of a ping pong match where employees hit the ball back and forth across the net either to other team members or to Customers and partners and the net result is dissatisfaction since the ball keeps coming back and there is little forward momentum as a unit. Despite progress by a few successful individuals – it is not a team effort.

Lastly, firms in the passion zone flourish and excel on their great positive energy and large amount of varying activities. Their employees feel joy and pride working in the organisation and all enthusiasm and excitement appears to be set on reaching shared organisational priorities.

Organizations in the comfort or resignation zones live in the past and have basically given up. Consequently, they are less likely to be successful, as they prefer standardised, institutionalized ways of working. They shun innovation and risk as well as suffer from conflicting priorities and a lack of

employee commitment.

Companies in the aggression or passion zones show urgency for productivity as they strive for larger-than-life goals. Their energy moreover supports them in aligning and channelling their powers and in directing them towards common goals and activities.

In short, the model suggests that high achieving organisations are full of energy. Businesses that work from a basis of passion or with passionate people for that matter, are likely to have the highest energy levels. Their work is not only driven by very positive factors but they do a lot to develop themselves and their people, too. Simply put, their cultures appear to be based on cohesion. The analogy here is of a football team (soccer for you folks in the USA) where the team has a common goal and each member knows his role within the team so that as a unit they are able to move the ball forward and achieve their goals together.

Landing Pages

Landing Pages are the weapon of choice for many marketers.

Marketers who do not employ Landing Pages either do not understand the

concept, or they are just plain lazy.

A Landing Page is more than just a duplicate of your sales page renamed

for a PPC campaign. A Landing Page often strips out many elements of

“effective design” and focuses on selling the product or service.

The main purpose of your Landing Page is to give the visitor two

choices: Buy or Leave. Nothing else. Don’t distract them with other

options. That is why they are there – don’t make the mistake of giving

them too much to choose from. If you want to get them to subscribe for

more information, fine. Then create a “name squeeze” page, but don’t

confuse yourself. Landing Pages are for one reason and one reason only

… to make a sale.

Here is a short laundry list of what I do when I create a Landing Page:

Font Face, Color & Size:

There is one thing that most people hate, and that is 4-5 different

fonts that clutter up the landscape of the page. Different Fonts for

headlines is fine. Different fonts in your body text is not good, it is

distracting. Don’t do it. Keep to one font in your body text. Testing

shows that the best “off line” (print) font is Times New Roman. This is

why it is the default font on the internet. Big mistake. Testing shows

that Times New Roman is one of the worst fonts online. Why? It causes

rapid eye fatigue.

The best fonts? Verdana and Arial. Standardize on Verdana as it

consistently outperforms every font out there in terms of reducing eye

strain and increased readability. Use standard fonts in the body of the

page, if you want an usual font for a headline, create it as a graphic

so it will look the same on every computer. You want your message to

have the look you intended.

The text should be readable. The standard size is “2”. Text should

always be dark on a light background (black text on a white background

is preferred). Landing Pages aren’t designed to allow you to show off

how “cute” you can be. This is serious stuff, you are selling. Put on

your “best face”.

Make the Links Easy to Find:

Now, having a cool CSS file that makes the links change colors, add or

remove underlines is fine on your site. Knock yourself out. However,

they have no business on your Landing Pages. Why? Because confusing a

visitor is not your priority, getting them to buy is.

Use standard linking practices to avoid confusion. If a potential

customer can’t distinguish between text and a link you are going to

lose. That’s not good.

Standard colors are:

* Unvisited Link – Underline in Blue

* Active Link (when the mouse “hovers” over the link – Red

* Visited Link – Purple

I recommend not messing around with the visited link, just have the

standard unvisited and hover so the visitor has some interactivity and

the link will “catch” their eye. I have done a ton of testing and the

standard linking practices always have better conversion ratios.

Color Scheme:

The colors you choose should match the product or service you are

selling. Soothing yellows, greens and blues are best for skin care. Pick

your color carefully as they will either bring the visitor in deeper

into the sales process or turn them away. A site for men shouldn’t have

pink as the primary color … or secondary color for that matter.

Not sure the colors to use? Look at the competition, as it is a great

place to start. And if you still aren’t sure, test.

White Space:

White space has been referred to as “negative space” by many designers

and thus, avoided. All of those designers should lose their jobs. This

is not high school art class. You are selling here, remember? White

space is good. White space is your friend.

When I look at a Landing Page with effective use of white space, I see

perfection. Without white space, text becomes unreadable, and the

graphics and other important elements become “washed out” and the

message is lost.

White space is more than just a background “color” – it is a part of

your conversion design. This also leads into another area, page

backgrounds. Don’t use them. Over the years I have seen floral designs

on iPod sites, vacation pictures as backgrounds, and even a woman and

her cat as the background …. and these were ALL landing pages.

Page Width and Page Height:

Have you heard the term “above the fold”? I am sure you have. It comes

from the newspaper industry and referred to ads and information that was

above the folded area. Testing found that 86% of the people who picked

up a newspaper at an airport, train station, office waiting room, never

“flipped” the paper over … they just looked “above the fold” only. The

same is true online. Did you know that of the people who don’t scroll

down that 6% of them don’t because they don’t know how?

Yes, you read that right. They don’t know how.

If your landing pages scrolls vertically on a 1024×768 resolution you

need to redo it. And if you are forcing a visitor to scroll

HORIZONTALLY, you are guilty of one of the worst web design mistakes of

all time. The scroll bar is your enemy. All of your important

information, including your Call to Action must be above the fold. Period.

Page Theme:

A Landing Page is geared to sell a particular product or service. So, if

I am doing a search for left-handed golf clubs or a Hawaiian vacation, I

am expecting to see a page about those topics. Don’t be lazy. Deliver

what I want, and I will be more likely to buy. Don’t dump me on a cookie

tracked version of your home page either. The content needs to match my

search. If not, I will most likely leave.

Stress Benefits, Not Features – Very few people care about features,

most care about benefits. Stress the benefits of the product or service

and you will increase your conversions.

Call To Action:

A no brainer, right? Wrong. Too many sites fail to have an effective

Call to Action. This is typical of most new and non-experienced sales

people. They fail to ask for the order. They just assume that the

prospects understands. Newsflash: They don’t. Explain what you want them

to do in easy to understand language, or an effective graphic. A “Buy

Now” is a Call to Action, and often a very effective one.

That’s it – we know you’ll be able to put these simple, but tested and

proven landing page strategies to work in your own business, whether

you’re an affiliate or marketing your own products.

How About Some Fishing?

We offer our Clients both the opportunity to learn/implement new strategies and the ‘pair of hands’ type consulting services where we roll up our sleeves to get the job done. What we’ve learned during the past 20+ years can be summarized as follows:

Give a man a fish and he will eat for a day. (Approximate cost: $25.00)

Teach a man to fish and he will go out and buy expensive fishing equipment, stupid looking clothes, a sports utility vehicle, travel 1,000 or more miles to the “hottest” fishing spot, and stand waist deep in cold water for hours covered with mosquitoes and flies just so he can outsmart a fish. (Average cost per fish: $1,495.68 mileage may vary – depending upon time available, quantity of fish biting, ability to maintain a calm and quiet demeanor and the level of patience on tap)

Summary: We’re always glad to help you to reel in a big fish – even if it means getting wet.

Contact us today.

Are You Running a RevGen Machine?

Here are 10 things I think about when a Client comes to us for help with their website.

1) Is there actually a market for your product?

By that I mean, are you absolutely positive that you’re selling a product or solution that people are actively looking for online – and not finding? That, by the way, is the formula for a successful business. The best way to answer this question is to do keyword research and confirm whether people are using search engines to look for a solution to the problem your product addresses — but not having any luck finding one. Our two favorite keyword research tools are Wordtracker and those available to Google Adwords users.

2) Are you getting enough traffic?

Before you can really judge your website’s effectiveness, you need at least 1,000 unique visitors (not pageviews). If you’ve only had 100 visitors and haven’t made a sale, be patient! You just need more traffic. Once you’ve reached 1000 visitors, then you can begin to assess how effective your site really is.

3) Are you getting targeted traffic?

If you’ve had 1,000+ visitors to your website and you still haven’t made a sale, find out where your visitor traffic is coming from. That’ll help you know if it’s targeted or not. The best way to get top-quality traffic to your site is by bidding on extremely targeted keywords in the pay-per-click search engines. By “targeted,” I mean, keywords that speak directly to the people who are most likely to buy your product. If you drive 1,000 visitors to your site using targeted keywords in your PPC ads and you still don’t make a sale, then we know the problem isn’t the quality of traffic you’re getting. It’s your website.

4) Is your headline effective?

If your site doesn’t have a compelling headline that clearly communicates a powerful benefit, your potential Customers aren’t going to stick around to read your offer. Writing a better headline is usually the easiest way to fix a floundering website. If you get more people to stay on your site and read your offer, more people will buy your product.

5) Are you distracting your visitors from your main sales message?

You need to get rid of everything that distracts your visitors. This includes: links to other websites, Google Adsense ads, banner ads for other products, free articles that don’t support the sale…

Keep your visitors focused only on buying your product and your sales will go up.

6) Are you using testimonials effectively?

Like I said in last month’s editorial, testimonials are one of your most powerful selling tools. Nothing says, “Buy it now!” like an unbiased third-party recommendation. If your site is brand new and you don’t have any testimonials yet, give your product to a few friends or better still – industry colleagues and ask them to provide you with testimonials and photos / videos on how well it worked for them.

7) Does your guarantee take away the risk of buying?

A good guarantee is an essential selling tool – especially on the Internet. Unless you’re a major brand (like Sony, Apple, Nintendo) that your Customers inherently trust, you need to let them know you’ll stand behind your product. Reassure them that if they’re not 100% satisfied they can send it right back for a full refund. And remember, a longer guarantee usually results in more sales – and fewer refunds!

8) Is your price too high? or too low?

Most people know that if you price your product too high, you’ll hurt your sales. But this can also be true if your price is too low. People get suspicious when the price is far below their expectations. They think it’s probably “too good to be true” – and as a result, they don’t feel confident making a purchase. Use some common sense when it comes to setting your price and do your market research to know where you fit into the market – consider your objectives… How do you want to be perceived – as a high end provider or a low price outlet etc.

9) Is your ordering system easy to use?

Just because you can figure out how to navigate through your ordering process, it doesn’t mean your average Customer can. If you want to make sure your ordering system is “user-friendly,” find a few friends who aren’t very Internet savvy and get them to order your product. Watch over their shoulders and take notes. Where did they get stuck? Make sure you fix whatever problems they encountered – because your potential Customers are encountering them, too!

10) Do you have good salescopy?

If you aren’t using well-written salescopy to sell your product, then you’ll never achieve online success. It’s that simple. It doesn’t matter whether your particular site needs short copy or long copy, the fact will always remain: Your product isn’t going to sell itself! You need to find the right words to do the job. If you are not confident with your sales message, your text or your pitch, let us know, this is something we do for our Clients all the time… in fact, all of the above 10 items help to give you an idea of some of the services BoxOnline offers Clients to move their business forward so that they too can succeed with their online ambitions.

Valuation Algebra

Ever wonder why many smart investors are able to calculate valuations and other investment related numbers in their heads? During deal negotiations, this used to both amaze and confound me until a good friend explained the process in terms that almost anyone can understand. It took me a while but I think I can safely say that even sophisticated entrepreneurs don’t grasp how valuation math works. VCs talk about pre-money, post-money, and share price as though these were universally defined terms that the average citizen is expected to understand. To ensure that everyone is talking about the same thing, I started forwarding the following explanation. Folks, this is about the math behind the calculations, not the philosophy of valuation.

In a private equity or venture capital investment, the terminology and mathematics can seem confusing at first, particularly given that the investors are able to calculate the relevant numbers in their heads. The concepts are actually not complicated, and with a few simple algebraic tips you will be able to do the math in your head as well, leading to more effective negotiation.

The essence of a venture capital transaction is that the investor puts cash in the company in return for newly-issued shares in the company. The state of affairs immediately prior to the transaction is referred to as ‘pre-money,’ and immediately after the transaction ‘post-money’.

The value of the whole company before the transaction, called the ‘pre-money valuation’ (and similar to a market capitalization) is just the share price times the number of shares outstanding before the transaction:

Pre-money Valuation = Share Price * Pre-money Shares

The total amount invested is just the share price times the number of shares purchased:

Investment = Share Price * Shares Issued

Unlike when you buy publicly traded shares, however, the shares purchased in a venture capital investment are new shares, leading to a change in the number of shares outstanding:

Post-money Shares = Pre-money Shares + Shares Issued

And because the only immediate effect of the transaction on the value of the company is to increase the amount of cash it has, the valuation after the transaction is just increased by the amount of that cash:

Post-money Valuation = Pre-money Valuation + Investment

The portion of the company owned by the investors after the deal will just be the number of shares they purchased divided by the total shares outstanding:

Fraction Owned = Shares Issued /Post-money Shares

Using some simple algebra (substitute from the earlier equations), we find out that there is another way to view this:

Fraction Owned = Investment / Post-money Valuation = Investment / (Pre-money Valuation + Investment)

So when an investor proposes an investment of $2 million at $3 million ‘pre’ (short for premoney valuation), this means that the investors will own 40% of the company after the transaction:

$2m / ($3m + $2m) = 2/5 = 40%

And if you have 1.5 million shares outstanding prior to the investment, you can calculate the price per share:

Share Price = Pre-money Valuation / Pre-money Shares = $3m / 1.5m = $2.00

As well as the number of shares issued:

Shares Issued = Investment /Share Price = $2m / $2.00 = 1m

The key trick to remember is that share price is easier to calculate with pre-money numbers, and fraction of ownership is easier to calculate with post-money numbers; you switch back and forth by adding or subtracting the amount of the investment. It is also important to note that the share price is the same before and after the deal, which can also be shown with some simple algebraic manipulations.

A few other points to note:

- Investors will almost always require that the company set aside additional shares for a stock option plan for employees. Investors will assume and require that these shares are set aside prior to the investment, thus diluting the founders.

- If there are multiple investors, they must be treated as one in the calculations above.

- To determine an individual ownership fraction, divide the individual investment by the post-money valuation for the entire deal.

- For a subsequent financing, to keep the share price flat the pre-money valuation of the new investment must be the same as the post-money valuation of the prior investment.

- For early-stage companies, venture investors are normally interested in owning a particular fraction of the company for an appropriate investment. The valuation is actually a derived number and does not really mean anything about what the business is actually ‘worth.’

OK… how about a shortcut if there are existing investors and you know both how much they invested and also the percentage ownership they have. Let’s say that investor Z paid $4m for 12% of company Y. This translates to 100%/12% = 8.3 and $4m x 8.3= $33.3m. So from the perspective of investor Z, the company was worth $33.3m at the time s/he purchased the shares.

Valuation and VCs

There’s this dance that entrepreneurs and venture capitalists do when it comes time to negotiate the economic terms of an investment. And it all revolves around valuation.

The question is what is the fair value of the business? This supposedly establishes how much of the company the venture capitalists will own for their investment.

But I think the concept of valuation is often misunderstood by the people engaged in this process. And it’s particularly true in early stage investing.

I do not believe that negotiating a valuation on an early stage venture investment has much to do with the current value of the business. If it did, why would a venture capitalist agree to a $10 million value for a business that will lose money for the next 2-4 years and has little, if any, revenue?

The fact is that almost all venture capital deals are done as convertible preferred stock investments. That means that the money VCs invest is more like a debt instrument in the event the business doesn’t work out very well. VCs get their money out before the entrepreneurs do if the deal goes sideways or down.

It’s only in the event that the deal works out that the percentage of the business (the thing that valuation is supposed to determine) matters in terms of how much money everyone makes.

Another important factor to consider is that only a relatively small portion of early stage venture investments really work out in the way they were supposed to when the investment was made. The following is from a friend of mine and I thought it was brilliant so, I thought I’d share his thoughts here with you – He calls it the 1/3 rule which goes as follows:

1/3 of the deals really work out the way you thought they would and produce great gains. These gains are often in the 5-10x range. The entrepreneurs generally do very well on these deals (the VCs do even better).

1/3 of the deals end up going mostly sideways. They turn into businesses, but not businesses that can produce significant gains. The gains on these deals are in the range of 1x-2x and the venture capitalists get most to all of the money generated in these deals.

1/3 of the deals turn out badly. They are shut down or sold for less than the money invested. In these deals the venture capitalists get all the money even though it isn’t much.

So if you take the 1/3 rule and add to it the typical structure of a venture capital deal, you’ll quickly see that the venture capitalist is not really negotiating a value at all. They are negotiating how much of the upside they are going to get in the 1/3 of the deals that actually produce real gains. A VC’s deal structure provides most of the downside protection that protects their capital.

I think it is much better to think of a venture capital deal as a loan plus an option. The loan will be repaid on 2/3 of their investments and partially repaid on some of the rest. The option comes into play in a big way on something like 1/3 of the investments and probably no more than half of all of a VC’s investments.

There is more to this whole issue of valuation because there are often follow-on rounds where the deal between the venture capitalists and entrepreneurs gets renegotiated. Let’s save that for another time.

Success Manifesto

I’d like to take you through what I believe are the eight core principles to success.

These apply online, as well as offline, in all aspects of our lives and in every phase thereof. The 8 principles are the culmination of 20 years and $500,000 invested in all types of books, live seminars, videos, lectures, CDs, DVDs, tapes, courses e-books, magazine articles etc – I ate them all up like candy and distilled what I believe is the core essence to success.

Read through the following with an open mind, if some of them help you or match your lifestyle goals then, by all means – apply them to your life, if they don’t, then find a few that do, having principles and a code of ethics dictates who you are and who you turn out to be, and the sooner you find yours and live them, the sooner you’ll get what you seek.

Here are the 8 principles:

Principle #1 – Action

Principle #2 – Objectives

Principle #3 – Focus

Principle #4 – Discipline

Principle #5 – Time

Principle #6 – Just do it

Principle #7 – Communicate

Principle #8 – Leverage

Sowing seeds in a garden is only the first step in order to be able to harvest something later – all of the above steps need constant care and attention so that you will be able to reap the rewards of your efforts over time. Nothing in life worth having is instant – this is a process and will take some effort… but in my humble opinion, it’s worth the effort.

1) Act. That is essence is all I want to say about this particular principle. Ok, I want to add one or two more lines. “Act or ye shall be acted upon” Translation: get up off your lazy ass and do something today to help you move toward achieving one of your goals.

2) If you don’t set a specific and measurable goal as a destination, how would you know that you got there? Each of us needs to list goals and objectives for every area of our lives. Then, when we achieve one of our goals – we have something great to celebrate. There is a shortcut but you probably won’t believe me until it happens to you. One of my mentors told me years ago “Picture yourself already having achieved your goal. Make the picture as vivid and real as possible and remember to see yourself in the end result of having achieved your goal.” This sounds easy and can be a really fun way to spend a few meditative hours but the fascinating thing about this technique is that it works – and it works really well.

3) This is something that all successful people have mastered. It does not matter what their chosen field was, they focused on achieving their goals and no obstacle stood in their way for long. In an age where instant gratification is the rule rather than the exception, attention deficit disorder seems to have replaced focus as the chosen path. My suggestion: Drop the ADD and pick up your list of goals, select ONE then do nothing else for 2 hours except work on achieving that specific goal. As with most things you need to get used to doing this so expect to get into a groove after a few attempts but make the effort and get started today.

4) Discipline has to do with choices. It links your goals with achievement and is an essential element to accomplishing your objecives. You need to know what is the best possible choice available to you to help you achieve your goal. Once motivation has subsided, usually it is discipline that gets the job done. Every successful individual I have ever read about or known personally, had an over abundance of self discipline.

5) The only finite resource we have is time. Don’t waste a drop. Enjoy the road and journey as much as you enjoy the destination. Work on efficient and effective activities – those things that are going to be moving you toward your end result. Ignore the rest and be sure to prioritize how you spend your day / week so that you maximize your achievement including time with friends and family.

6) Take responsibility for action and follow through. There is no such thing as quitting or turning back. You simply need to move forward and get the job done – that’s it. Just do it and do it with compassion, honesty and integrity.

7) If you are going to look at your life with the end result in mind then do the same for communication too. If your intended message is received crystal clear by the person with whom you are communicating then mission accomplished. One way to accomplish this is to collect your thoughts on the person with whom you are communicating and put on their shoes… say things to them in a way that they will understand – speak their language – use words that they too would use. Then test this by asking them to explain what they just heard in their own words and compare it to your intent.

8) We can leverage time, money and knowledge in the pursuit of our goals. When you outsource grunt work to others you are leveraging your time. When you can use OPM to achieve an objective and score a win-win in the process you are leveraging your money. Knowledge on its own is without much value until it is applied. Know where to go to get help with achieving your specific goals by doing a bit of research. If you need help, hire a specialist and get the job done… when you do this, you are leveraging knowledge as well.

It all boils down to this:

Know what you want

Make a plan to get it

Focus on your dream

Have the discipline to work on the goal regularly

Reserve time for what is important not what is urgent

Just do it

Remember to communicate effectively so that the core message is received as intended

Leverage your time and apply the abundant knowledge of experts to get what you want

Good luck and enjoy the ride!